“A healthy family enterprise must spend time in four distinct rooms: the Business Room, the Family Room, the Ownership Room, and the Board Room”

— Josh Baron & Rob Lachenauer

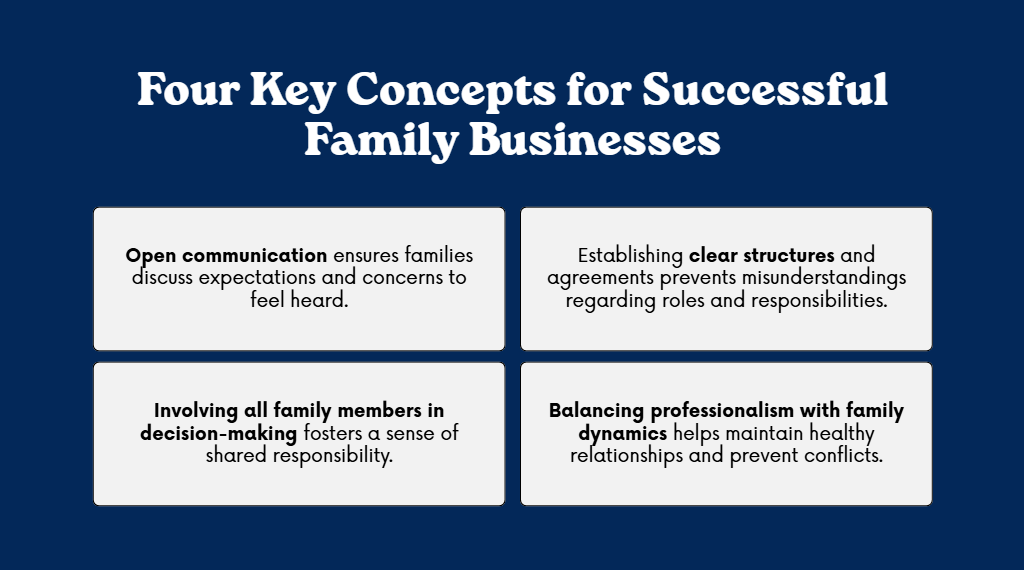

In our previous post, we explored key strategies for fostering unity within family businesses: from open communication and inclusive decision-making to establishing clear structures and balancing professionalism with family dynamics. These practices are essential first steps toward strong family governance. But as families grow and businesses become more complex, these strategies need to be supported by the right organizational design—a system that helps ensure the right conversations happen in the right way.

The 4 Room Model

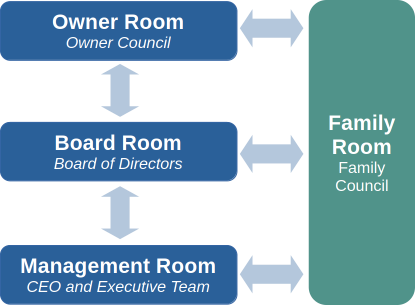

The Four Rooms Model by Josh Baron and Rob Lachenauer provides a structured framework for understanding and managing the complexity of family enterprises. It identifies four distinct but interconnected domains that every family business must engage with intentionally. Each “room” represents a different aspect of the system:

- Business Room focuses on operations, performance, and strategy

- Family Room deals with emotional bonds, communication, and shared values

- Ownership Room governs rights, responsibilities, and capital structure

- Board Room provides governance, accountability, and long-term perspective

As family businesses grow, the decisions they face become more complex—and so do the relationships that underpin them. While structures and agreements lay the foundation for stability, true governance comes from knowing where each type of decision belongs, and who should be making it.

That’s where the Four Rooms Model becomes most valuable—not as a theory, but as a tool for dialogue. The questions below are designed to help you reflect on how your family enterprise functions across the Owner, Board, Management, and Family rooms. They don’t offer quick answers—but they will show you where to look, what to clarify, and what conversations may be missing.

The Ownership Room

(Exclusive domain of owners; decision‑making over identity and capital)

- Who really belongs in this room?

Who qualifies as an owner—beneficiary, trustee, non‑voting shareholder, next generation, spouse? Should future generation members or other stakeholders sit at the table yet? - What decisions belong only here?

Which issues are never delegable—e.g. policies on share transfer, company sale, debt thresholds, major rewrites of strategy, or naming board members? - How should decisions happen?

Will the room use vote, voice, or consensus rules? Will a shareholder meeting coexist with an owner council? - What signals when this room is weak or missing?

Could decisions that should land here have been taken in the board or family room instead?

Reflect: Is everything that matters to us as owners actually going through this room—and with clarity and authority?

The Board Room

(Bridge between ownership and execution; impartial oversight)

- Why do we need a board room at all?

If the Owner Room sets the high‑level agenda, doesn’t the Management Room do the work anyway? Its purpose is to review, debate, and align business plans against owner goals. - Who should sit at the board?

How do we balance family directors, independents, and maybe a non‑family chair to ensure fairness and impartiality? - What kind of authority does the board hold?

Should it only oversee, or could it inadvertently start “operating”? How do we keep debate disciplined and tied to our owner strategy? - What happens when this room is “messy”?

Could executive dominance or family pressure be warping board decisions? Are we using it to referee conflicts or just to rubber‑stamp whims?

Challenge: Does our board act as a shock‑absorber or is it becoming a flashpoint?

The Management Room

(Day‑to‑day execution; real operations)

- Who belongs here?

Which family members are executives? Which require an explicit mandate to enter? And who should be strictly outside? - What decisions belong here—and not in the Owner or Board Rooms?

Daily operations, strategic implementation, hiring and firing—not dividend policy or capital structure. Are roles strictly compartmentalized? - How do managers know when to escalate?

Is there clarity on when non‑operators must defer to higher rooms? Does a family member need an owner or board invitation to speak up?

Reflect: Is our management system carrying out strategy with focus—or is it cluttered by overlapping authority?

The Family Room

(Emotional cohesion, next generation, and informal bonding)

- Who participates in the Family Room?

Do we include spouses, beneficiaries, even those no longer shareholders? Or have divorced or non‑active branches gradually faded without clarity? - What topics belong in family discourse?

Relationship expectations, values, legacy, talent development, conflict resolution—not business performance or budgeting. - How is it structured?

Do we convene family council, family assembly, or both? Are these leveraged for education, unity, and informal feedback loops?

Challenge: Is this room enabling the next generation—or leaving them alienated from family identity?

The Movement Between Rooms

Baron and Lachenauer warn against staying too long in one room. Some families never leave the Family Room, afraid of professionalizing. Others obsess over the Business Room, letting relational trust decay. The healthiest enterprises move fluidly, with awareness and intention.

So let’s ask:

- Which room are we most comfortable in?

- Which room have we neglected—and why?

- What conversations must we have to move forward?

Final Reflection: Where Do You Begin?

The beauty of this model lies in its simplicity—and its depth. It doesn’t offer a rigid playbook, but a compass. The answers are not in the rooms themselves; they’re in the conversations we’re willing to have inside them.

- Can a family truly succeed in business if it only acts like a business?

- What does it mean to love your family and still say no in the boardroom?

- What legacy are we leaving—in our balance sheets, and at our breakfast tables?

Start with the questions. The rooms are already there. What matters is whether you’re willing to walk through the doors.

References

For further information you can visit the website of the creators of this framework